Printable Form To Report Income To Rent House – If you incurred a loss, you may be able to deduct this amount from your overall income, but you should check with an accountant or a knowledgeable bookkeeper on the. How do i report the income? If you only rent a portion of your home, then all expenses relating to the home must be adjusted based on the square footage of the rental space. Salary from a job) and report the total on irs form 1040.

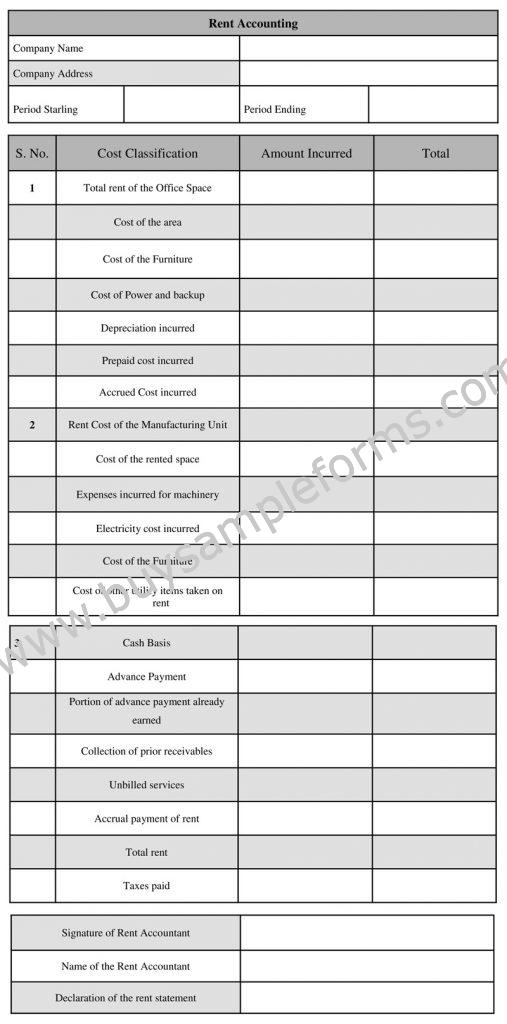

Rent Spreadsheet Template Within Rental Property And Expenses

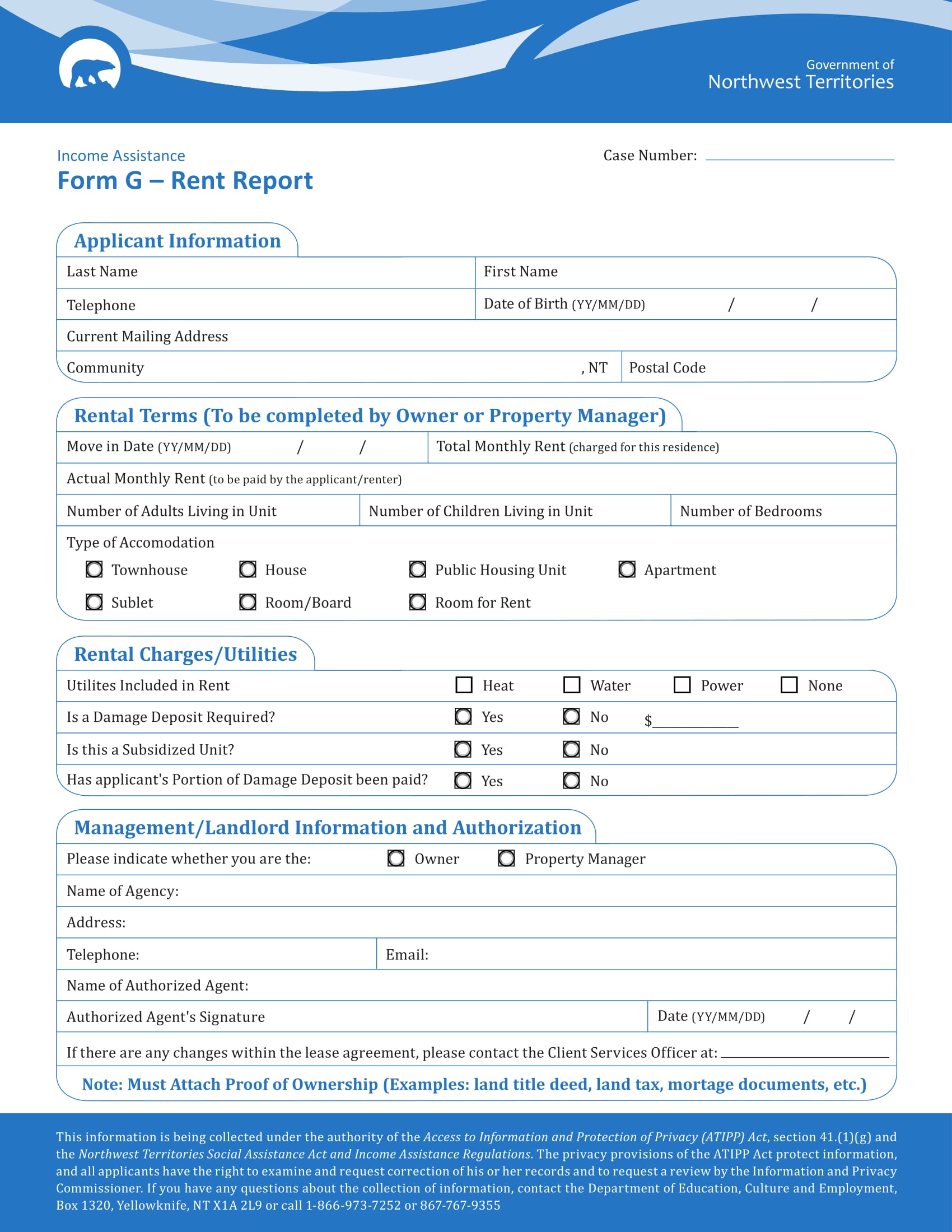

Printable Form To Report Income To Rent House

Rental property spreadsheet investing in rental property can be an appealing alternative to owning traditional stocks, which can be volatile. Kansas income tax, kansas dept. You must include $10,000 in your income in the first year.

Here Are The Steps You’ll Take For Claiming Rental Income On Taxes:

Form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. How to report a landlord not paying tax. Enter the result here and on line 18 of this form:

If You Suspect That Your Landlord Is Guilty Of Tax Fraud, You Can Fill Out Irs Form 3949A And Submit It To The Irs.

Appropriate sections are broken down by month and by property. List your total income, expenses, and depreciation for each rental property. You can use one schedule e form for up to three properties at a time.

Home About Publication 527, Residential Rental Property (Including Rental Of Vacation Homes) Publication 527 Discusses Rental Income And Expenses (Including Depreciation) And Explains How To Report Them On Your Return.

Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on how to file. Income and expenses on a rental property are reported to the irs using two main forms: To download the free rental income and expense worksheet template, click the green button at the top of the page.

You Can Generally Use Schedule E (Form 1040), Supplemental Income And Loss To Report Income And.

Schedule e is used to report income from rental properties, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. You’ll use this form to report income and expenses related to real estate rentals. Of revenue po box 750260, topeka, ks.

Use The Same Format As On Schedule E.

List your total income, expenses, and depreciation for each rental property on schedule e. If you rent buildings, rooms, or apartments, and provide basic services such as heat and light, trash collection, etc., you normally report your rental income and expenses on schedule e, part i. (please print) date of birth (mmddyy) relationship social security number:

Locate Schedule E, Part I.

If you’re a landlord or local government looking for a way to collect information from renters, try this tenant income declaration form to. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Most investors use “cash basis” accounting, which means that rental income is recorded when it is received and that expenses are deducted when the.

Each Section Automatically Calculates The Totals To Provide Your Gross Income, Net Income And Total Expenses For The Year.

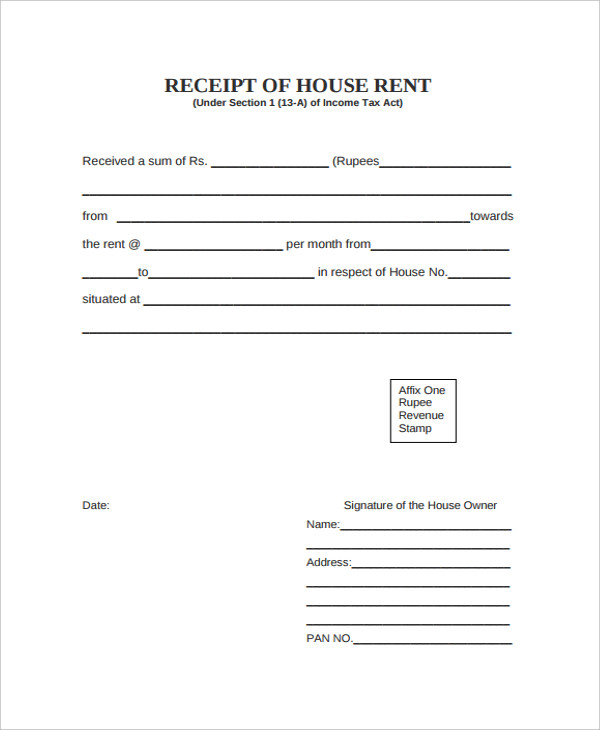

If you earned a profit from your rental property activities, you should add this amount to your overall income (i.e. Typically, the rental income tax forms you’ll use to report your rental income include: Rental property can generate recurring revenue, appreciate over time, and provide tax benefits.

You Can Also Report Suspected Fraud To Your State Franchise Tax Board By Visiting Its Official Site And Looking For Information On Fraud Reporting.

If you have more than three properties, you’ll need to attach additional schedule e forms as necessary to report all your properties. Schedule e (form 1040) is used to report income and loss from a rental property to the irs each year. In the first year, you receive $5,000 for the first year's rent and $5,000 as rent for the last year of the lease.

In General, You Can Deduct Expenses Of Renting Property From Your Rental Income.

Security deposits used as a final payment of rent are considered advance rent. How to report rental property income? Include it in your income when you receive it.

See Irs Publication 527 Residential Rental Property For Additional Information.

The rental income and expenses should be reported on schedule e. You will almost always report your income on schedule e of form 1040. A tenant income declaration form is a questionnaire that must be filled out by a person applying for rental relief.

You Can Attach Your Own Schedule (S) To Report Income Or Loss From Any Of These Sources.

This is where you’ll list your total income, expenses, and depreciation for each rental property.

30 Rent Increase form Example Document Template

Printable House Rent Receipt Templates at

Printable Sample Late Rent Notice Form in 2019 Real estate forms

FREE 6+ Rent Report Forms in PDF

Printable Rent Accounting Form Rental Accounting Template

Free Printable House Rental Application Form Free Printable

Printable and Expense Form —

Rent Application Form Free Printable Documents

Rent Invoice Examples 13+ Samples in Google Docs Google Sheets

Rent Spreadsheet Template within Rental Property And Expenses

FREE 6+ Rent Report Forms in PDF

Rent Application Form Free Printable Documents

Rental And Expense Worksheet —

30 Free Rent Increase form Example Document Template

Fillable Rental Worksheet Template printable pdf download